Digital Advertising Giants

Overview

- Google and Meta (formerly known as Facebook) are the largest online platforms that are funded by digital advertising. Their business model relies on attracting consumers’ attention and gathering data about them, which they use to sell targeted advertising.

- The services provided by both companies are highly valued by consumers. Search engines give us instant access to information, news and a wide range of goods and services. Social media services enable us to connect with friends and family around the world, keep up with news or current trends and share creative content with one another. Both platforms have opened up access to sophisticated and targeted advertising for millions of small businesses around the world. Both companies are also able to gather substantially more data about consumers than their rivals.

- Both Google and Meta are highly profitable. Our analysis demonstrates that both companies have for many years been earning profits that are substantially higher than any reasonable estimate of what we would expect in a competitive market.

- We are assessing whether problems such as market power, lack of transparency and conflicts of interest mean that competition in search, social media and digital advertising is not working as well as it should.

- These issues matter to consumers: if competition in search and social media is not working well, this can lead to reduced innovation and choice, while poor competition in digital advertising can increase the prices of goods and services across the economy, and undermine the ability of newspapers and other providers who rely on digital advertising revenue to produce valuable content.

The business model of platforms funded by digital advertising

Online platforms typically seek to attract consumers by offering their core services for free. Once they have attracted a critical mass of consumers, they seek to make money from business users on another side of the platform. In transaction-based platforms, such as Amazon Marketplace or Apple’s App Store, this is predominantly through the commission that is charged to retailers or app developers respectively.

For other platform services, such as search engines and social media services, monetization comes predominantly through serving ads. More specifically, they make money by selling inventory to advertisers. Advertising ‘inventory’ is a space, whether located on a billboard, in a newspaper, on a web page, or on a TV screen, where adverts can be displayed. In an online setting, inventory is essentially empty space on a web page or mobile app, which can be filled with text (including links to other websites), images, and videos. Google and Meta are by far the largest two companies operating with this business model.

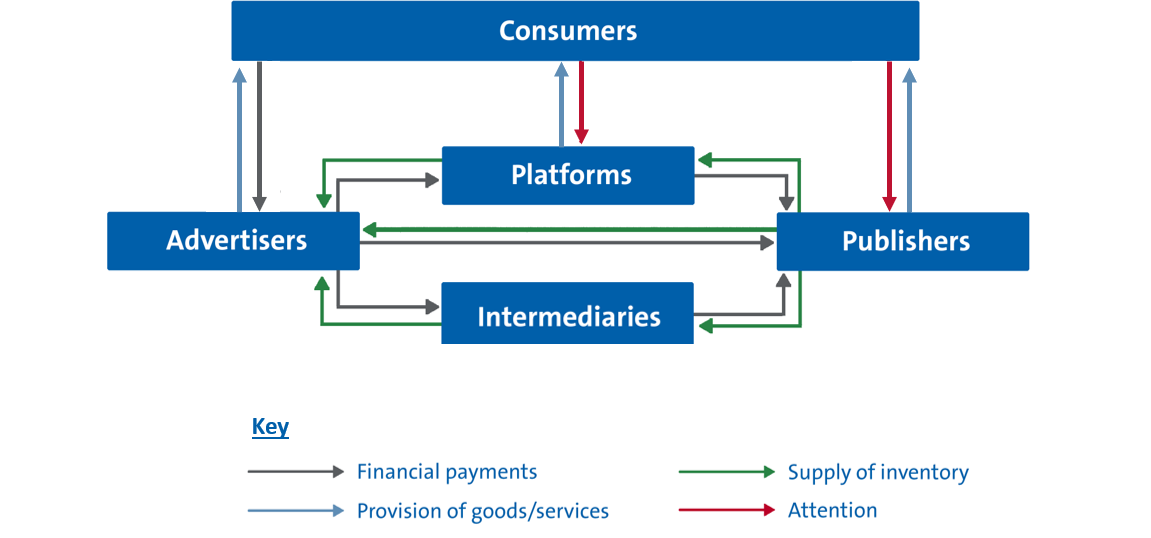

Although consumers do not pay money for these services, there is still an exchange that takes place between them and the platform. In exchange for searching the Internet, watching videos, or communicating with friends, consumers provide their attention and data about themselves. Advertising- funded platforms are able to combine the attention of their users with contextual or personal information they have about them to serve highly-targeted ads, which are in high demand by advertisers. These exchanges are illustrated in the Figure below.

Figure: Consumer services supported by digital advertising

Source: CMA assessment.

The advertising-funded business model is not novel, nor is it inherently problematic from a competition perspective. Newspapers have been generating revenue through advertising for several hundred years. Similarly, radio and television have been generating revenue through advertising for years. These services have added substantial value to our society.

The same is true of many services provided by digital platforms. Search engines give us instant access to information, news, directions, and other websites with minimal effort. Social media services enable us to connect with friends and family around the world, make new friends, keep up with news or current trends, and share creative content with one another. These services, which are funded by digital advertising, are highly valued by consumers.

The value of online platform services

Platform services that are funded by digital advertising bring substantial benefits to consumers, while being provided free of charge. Research published in 2018 demonstrated that consumers place great financial value on a range of online services, with values of multiple thousands of dollars being assigned to search engines and digital maps. Video streaming services such as YouTube, and social media more broadly received lower, but still significant valuations.

The fact that these services are so important to consumers and valued so highly is precisely why it is critical that competition is effective in these markets. The current COVID-19 pandemic has emphasized the critical importance of digital services for consumers’ well-being and prosperity. It is important to ensure that current consumers are reaping the maximum potential rewards from these services, and that future consumers will continue to benefit from new innovative services that can transform our lives.

The targeted nature of digital advertising can add value to both advertisers and consumers. For consumers, targeted adverts will be more relevant to them, which can make them less irritating and more likely to provide genuinely useful information about products and services they may be interested in. For advertisers, improved targeting should deliver a greater return on their investment as their adverts will be viewed more often by their intended audience. Overall, more relevant and better targeted adverts can be expected to result in more purchases, increasing consumer and producer welfare as a result.

Platforms such as Google and Meta have made it substantially easier for businesses to reach and serve adverts to consumers all around the world, in a way that was only previously possible for large companies. This has opened up greater advertising possibilities for a long tail of small businesses, and enabled large numbers of predominantly online businesses to thrive that may otherwise not have been viable.

Despite these benefits that online platforms have undoubtedly delivered, the markets within which they operate contain a range of features that mean they frequently tend towards a ‘winner-takes-most’ dynamic, with limited competition ‘in’ or ‘for’ the market, and with demand often aggregated by one or sometimes two very large platforms. This may result in sub-optimal outcomes for consumers in these and other markets over the longer term.

Google’s and Meta’s positions in respect of consumer attention and data

There are two key factors that influence the revenue that online platforms and publishers can generate through digital advertising:

- Capturing consumers’ attention: this is an essential requirement for selling any form of advertising inventory. The more of consumers’ attention that platforms can capture, whether that is through increased reach or keeping consumers online for longer periods, the more attractive the platform’s inventory is to advertisers, and the more inventory they will have to sell.

- Understanding preferences, purchasing intent and behavior: understanding the wants and needs of specific consumers at any point in time is valuable to advertisers as they can target their adverts towards those individuals that they suspect are most likely to make a purchase. This targeting – whether it is based on contextual information such as the subject of a web page, or on personal data such as the individual’s age or recent purchases – can result in a higher return on investment for advertisers, and a willingness to pay higher prices. Similarly, advertisers are more likely to be willing to pay high prices in the future if they are given evidence that consumers exposed to adverts on a platform went on to make a purchase. Platforms are therefore rewarded by advertisers for having extensive and up-to-date knowledge of their consumers’ characteristics, preferences, and behavior. The key input to this knowledge is data.

Competition & Markets Authority. Online Platforms and Digital Advertising Market Study Final Report, July 1. 2020

Text edited to refer to Facebook by its new name Meta.

Contains public sector information licensed under the Open Government Licence v3.0